Our Philosophy

Our Philosophy

Our philosophy is simple: we look for high-upside, low-downside deals in business that are:

1. Easy to understand

2. Have a durable competitive advantage

3. Competent management

4. Purchased with a margin of safety

5. Exhibit some catalyst or event to drive our returns

If we do what everyone else does, we should expect average results!

In order to outperform, we must think differently than everyone else!

Process is King!

Much like engineering specialties, we believe that process is king! Process is vital to making good investments based on data and value!

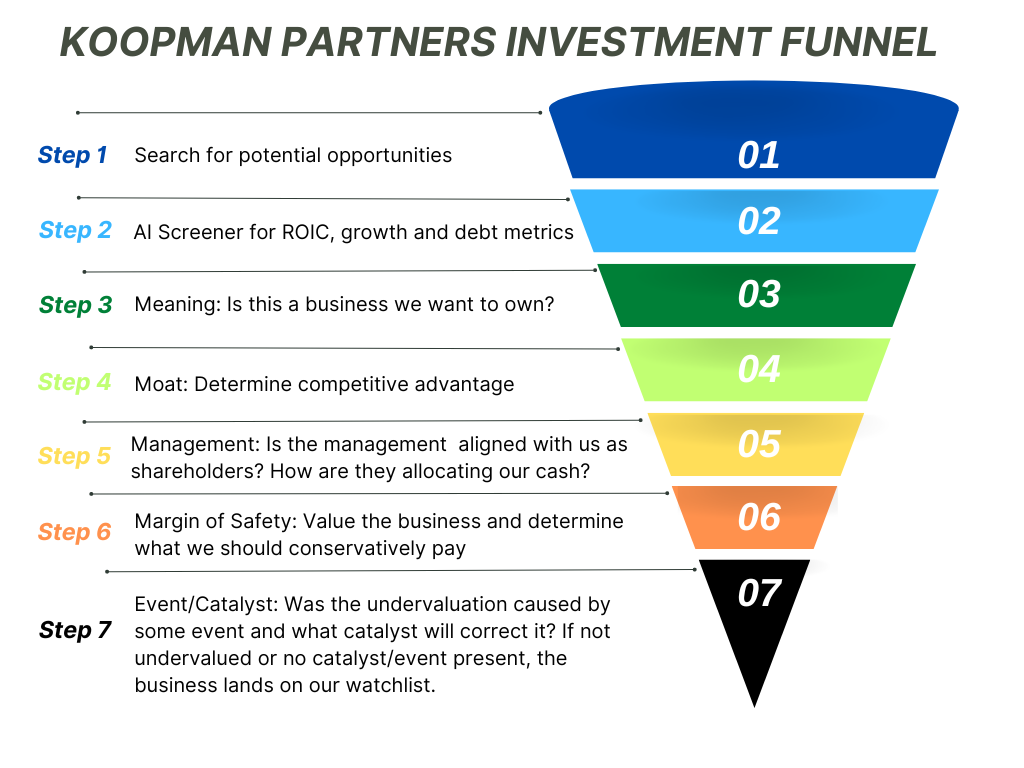

Using a checklist, we ask ourselves over 85 questions within the following seven steps to help determine if the business is a good investment for our firm. The checklist serves as a guide and guardrail to prevent us from making decisions based on hype and emotion.

We are constantly evaluating and improving our process for finding and evaluating investment ideas.

What We Do

- The mindset is that we invest in businesses- not stocks

- Concentrated Portfolio- Generally 5-10 businesses

- Long time horizons

- Invest as opportunities present themselves

- Invest with a “margin of safety”

- Incentives aligned with partners:

- Fully invested manager

- 25% performance fee above 6% per annum

- Transparent and candid operations

- Find opportunities with high upside and low downside

What We Reject

- Modern Portfolio Theory

- Volatility as a measure of risk

- Diversification (rather; over-diversification)

- High Returns = High Risk

- Efficient Market Theory

- Ticker price = business intrinsic value

- The “Ticker” approach

- Speculation

- Hot Stocks

- Initial Public Offerings (IPOs)

- Borrowed Funds/Margin Debt

- Emotional Decision Making

- The Wall Street hive mind

Over time, you will see links to the blog page entitled “Manager’s Thoughts” where you can find a more in depth discussion of the points made here.

Our Manager

Sean Koopman is the Founder and Managing Partner of Koopman Partners LP

Mr. Koopman graduated with a Bachelor of Science Degree in Mechanical Engineering from the University of Iowa in 2018. After a successful five years in power generation and aerospace industries, he left his corporate engineering career behind to pursue a greater challenge: business and investment in public equities. Since the onset of the COVID-19 pandemic, he has devoted nearly all of his spare to time learning, reading and practicing how to invest like the very best in the world: Warren Buffett, Charlie Munger, Phil Town, Guy Spier, Monish Pabrai, Peter Lynch and many others. In July 2020, with the full faith and backing of his spouse, he withdrew 401(k) accounts to apply what he learned to their investments. After nearly three years of superior performance, he decided to share his approach to investments with others in the form of Koopman Partners. He is fully devoted to his investment practice, lifelong learning and constant steady improvement in all that he does.

For the full story click here.

Get in Touch

Ready to learn more? Reach out to start a conversation today!